Do you want to know the popular e-wallets which are used by the consumers in India to avoid the crash crunch caused by recent demonetization of 500 and 1000 rupee notes? Check out these super cool Mobile wallet Apps…

The recent demonetization of 500 and 1000 rupee notes had created a huge momentum among the public for moving towards a cashless economy. Since people could not withdraw cash for their day-to-day transactions, everyone started switching to online banking and mobile wallets for making their purchases. It’s always difficult to change the consumer behaviour especially in the rural sector, but this sudden announcement by the government has triggered lot of changes among the public. People have now started welcoming the use of technology and digital wallets for their day-to-day transactions. Some of the popular e-wallets which are used by Indians today are listed below.

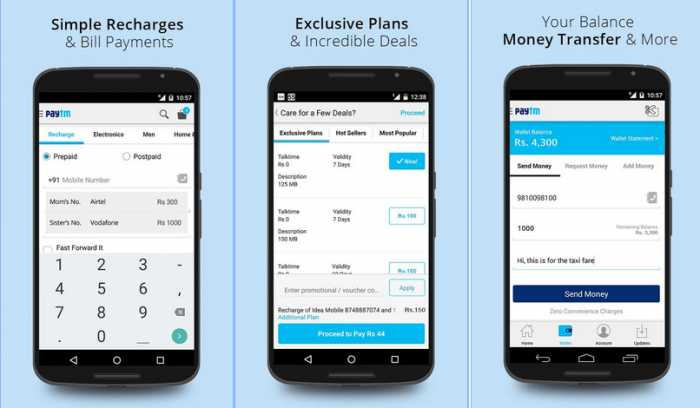

PayTM:

PayTM has become the most popular mobile wallet among consumers in India because of its user-friendly nature and wide acceptance in all the commercial places including super markets, malls, coffee shops, restaurants etc. PayTM App was launched in the year 2010 on a semi-closed model where consumers could load money from their bank accounts and make payments to merchants that have tie-ups with PayTM. Apart from making e-commerce transactions and online payments, you can also pay your mobile, electricity and other utility bills, transfer money to friends, book train, bus or movie tickets and also use it to pay all merchants who support PayTM payments. With the recent demonetisation of Rs. 1000 and Rs. 500 notes, PayTM reached a record high of 5 million transactions per day compared to its previous range of 2.5-3 million transactions. They expect to process transactions worth more than Rs. 24,000 crores by end of this year. It is the most downloaded Mobile wallet app in Google Play with more than 50 million downloads as of now. You can pay any merchant instantly by just scanning the QR code present in their location. The main reason for its popularity is the numerous cashbacks and offers they provide to their users.

State Bank Buddy:

It is also a popular e-wallet application from the biggest and most trusted bank of India. State bank buddy supports more than 13 languages and allows users to send or receive money using their mobile number. You can also pay your utility bills, book movie or flight tickets, do online shopping and pay at restaurants using this cool App. The users can register instantly and add money to their wallets from their bank account. You can transfer money to any contacts on your phonebook and recharge your mobile using this App. You can also pay your Internet or DTH bills and shop online in any ecommerce store. They have 24*7 customer support available to handle all your queries.

MobiKwik:

Another popular e-wallet for the cashless Indian is MobiKwik which offers a simple and hassle-free way to make your payments. MobiKwik has tie-ups with more than 50,000 retailers and makes your shopping, ticket booking, bill payments and online recharges much easier and faster. You can top-up your mobile and recharge your DTH connection using this App. It also supports all kinds of utility payments like Gas bills, Electricity bills, broadband bills and insurance payments. The App is trusted by more than 40 million users for cashless shopping, bill payments and online recharges. Some of the popular brands like Bookmyshow, Big Basket, Van Heusen, Dominoes, Big Bazaar, Grofers, PVR, Myntra, Jabong, Redbus and many other vendors have tie-ups with MobiKwik. Also they have partnered with more than 5000 restaurants all over India.

PayUMoney:

PayUMoney App allows users to pay bills, recharge online and shop online. You can setup automatic bill payments and get reminders for your utility bills. It’s very user-friendly and anyone can register instantly. Once you load your wallet using net banking or credit card, you can start making payments and transfer money to your friends easily. This App was developed by a Gurgaon based company to help users store cash in their wallet and pay for different services without having to pay from credit card or debit card every time. They have some unique features like one-touch checkout, instant refunds and various cashbacks to attract users.

ICICI Pockets:

Pockets by ICICI Bank is a user-friendly mobile wallet to shop anywhere and pay anyone instantly. This App supports QR Code, NFC and UPI based payments. Once you register with this App, you will get a free virtual VISA card which you can use to do online shopping at various e-commerce stores. You can also request a physical card to shop at various merchants that have tie-ups with ICICI. The App allows users to make secure payments to other bank accounts or contacts through UPI (Unified Payment Interface).

Many users have switched to e-wallets recently after recent crash crunch caused by government’s demonetization drive to eradicate black money. Hope all the consumers will move towards a cashless economy by adopting these latest technologies.