Online pharmacy startup 1 Mg is planning to raise fresh funds through debt route from existing investors, according to company’s latest regulatory filings that Techpluto’s team has duly accessed. After accessing the regulatory filings, Techpluto has learnt that 1 Mg has allotted 38,668 class 6 CCD (compulsory convertible debentures) to six existing investors at a face value of Rs 34, 417, 87 each for raising INR 1,33, 08, 70, 197.

Techpluto’s mail to 1 Mg for confirming the report of debt funding went unanswered at the time of filing the story. We’ll update the story as and when we get an official response from the company. Notably, the company had last secured funds barely five months ago, raising 10 Mn or INR 71 crore from Bill and Melinda Gates Foundation; this round was preceded by $70 Mn series D round in June 2019.

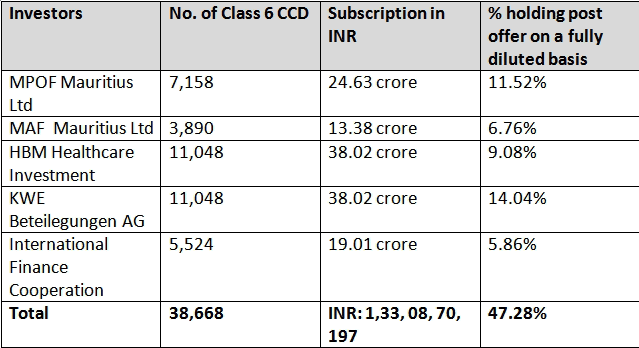

The above mentioned six investors include MPOF Mauritius Ltd, MAF Mauritius Ltd, HBM Healthcare Investments (Caymen) Limited, KWE Beteilegungen AG and International Finance Cooperation.

Below is the complete break-up of the share allotment and subsequent changes in stakeholder’s holding.

Founded in 2015, over the years 1 Mg has emerged as one of the poster boys of India’s nascent online pharmacy industry. According to analytics website Crunchbase, the company has till date raised approximately $175 Mn through 14 funding rounds, making it amongst the most well-funded startups in the epharmacy space. Its core competitors include Netmeds, PharmEasy, Medlife and MedPlusMart.

Indian government’s decision to include telemedicine among essential services has certainly given massive growth impetus to the online pharmacy industry. However, several industry experts claim that the sector still continues to face several regulatory-related problems.