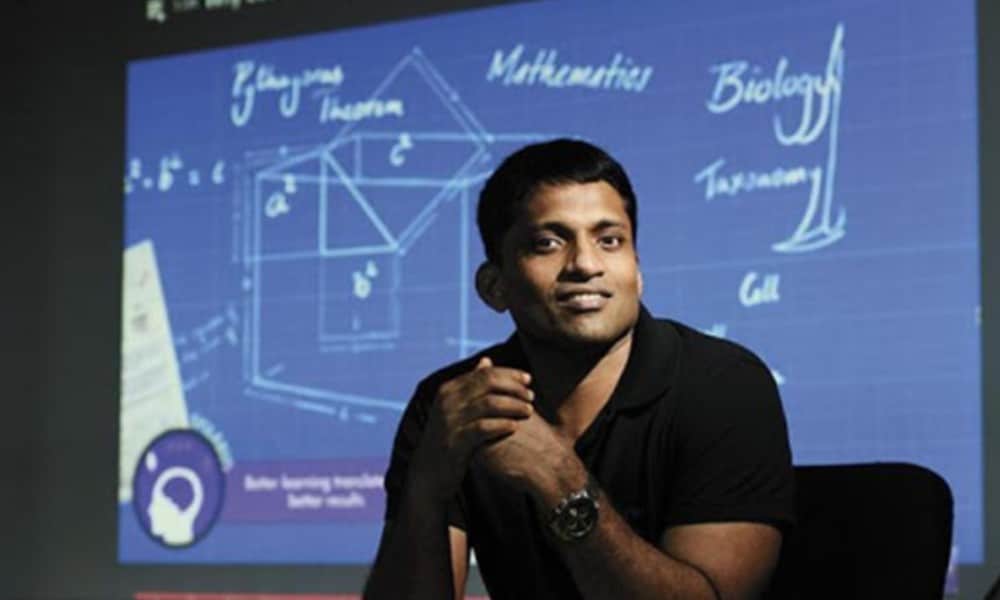

Just day after acquiring WhiteHat Jr for $300 Mn, Byju’s founder & CEO Byju Raveendran has dropped a hint about Byju’s IPO. In an exclusive interview with Mint, Raveendran said that Byju’s business has reached to a stage where it can seriously plan for an IPO sooner. However, he added that the company has not decided any exact timeline for the same.

Raveendran asserted that since Byju’s is a profitable business and boasts net cash flow, it is no longer under pressure to give exits to existing investors. He claimed that all the existing investors are thinking long term, hinting that their long term strategy augurs well for the company’s IPO plan.

Although Techpluto did not access Byju’s regulatory filings at the timing of filing this story, considering that the company’s has had 16 funding rounds till date all its existing investors must have surely got profitable exits.

Byju’s mulling an IPO strategy won’t come as a major surprise given that the company has everything going in its favor. From being the only profitable startup in India’s consumer internet space to being the world’s most valued edutech startup.

The company hit profitability in FY19, clocking a net income of INR 20.6 for the last financial year. This meant that in the last financial year company’s total revenue surpassed its total expenses for the first time since its inception in 2011. Its total revenue for FY19 stood at Rs 1,341 crore while its total expense for the same period stood at Rs 1321.65 crore.

For FY20, the company said that its revenue more than doubled to clock Rs 2,800 Cr revenue. This was revealed recently by Byju’s co-founder Divya Gokulnath in an interview with Business insider.

Analysts claim that the Bengaluru based edutech major has reached a stage where it can’t think about anything but scaling its business further. This is reflected through its latest M&A strategy that is mainly focused on helping its business grow in the non-core markets.

WhiteHat Jr’s acquisition will help Byju’s to grow aggressively in the U.S and other international markets. The Tencent and General Atlantic backed company has been pretty open about its ambition to expand in foreign markets. The company already has presence in the U.S and other international markets and will hope for further consolidation following WhiteHat Jr’s buyout.

WhiteHat Jr, which offers online coding classes to K-12 students, already boasts sizable presence in the American market. WhiteHat Jr’s founder and CEO Karan Bajaj claim that the US market constitutes almost 50% of the company’s $150 Mn annual revenue rate. He further added that the company will go live in Canada, Australia, UK and New Zealand by end of this month.

As for its domestic expansion is concerned, Byju’s is betting this on its next acquisition target ‘Doubtnut.’ Focused on solving Maths & science queries for k-12 students, Doubtnut’s large chunk of customers come from tier 2 and smaller towns where Byju’s comparatively has a weak presence.