Stung badly by coronavirus pandemic, the last six months of the year 2020 has turned out to be one of the most challenging periods not only for the Indian startups but also for the entire global economy. But to decode just how Indian startups fared during these six months including in the last three months when the shadow of coronavirus was looming large, we bring you semi-annual factsheet of Indian startups in 2020; spanning across the period January to June.

The comprehensive factsheets depicted in the below graphs, charts and figures have been prepared by Tracxn – one of the world’s largest platforms for tracking startups and private companies. Today Tracxn covers 300+ technology sectors and 800+ emerging themes, with dedicated coverage on 30+ countries.

The below factsheets cover pretty much every important facet – funding rounds, investors, acquisitions and therefore gives the most comprehensive coverage of the Indian startups during the H1 or first half-year of 2020.

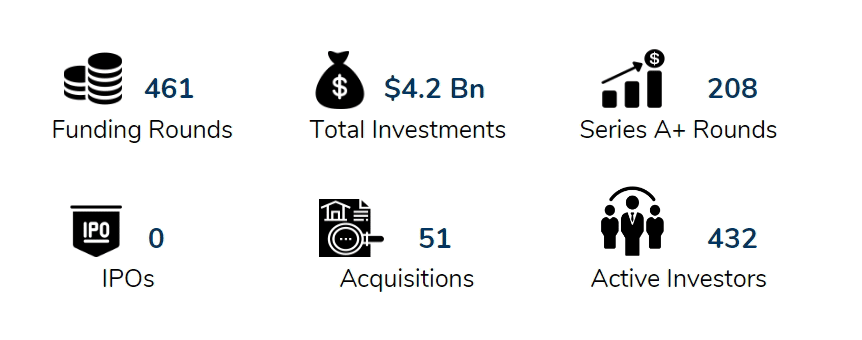

The figure below gives an overview of how the Indian startup fared during the first half of 2020….

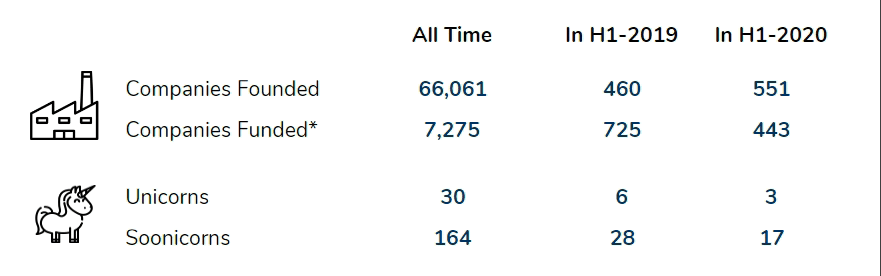

The data below gives a comparative picture of unicorns and Soonicorns during the first year of 2019 and 2020.

Unicorns are companies with $1 Bn+ valuation while Sonnicorns are companies that have the potential to become a unicorn in the near future.

Funding Trends

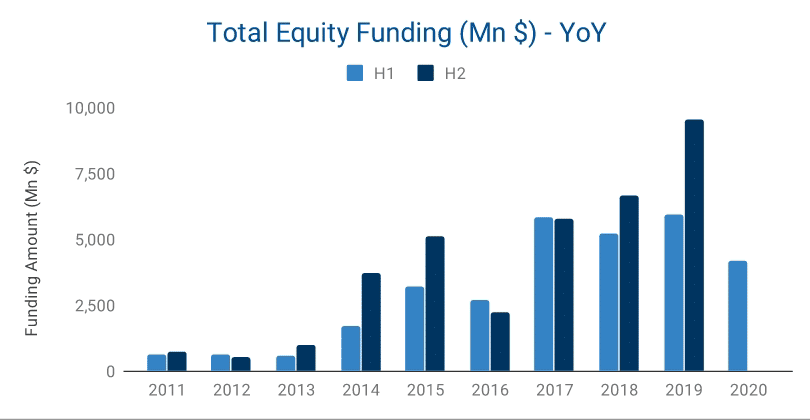

Owing to the pandemic crises, the funding activities in H120 obviously dipped as compared to H119. During first six months of last year Indian startups managed to attract total funding of $5.9 Bn while the funding dropped to $4.2 Bn in H120.

The chart below shows current as well as historic data on total funding raised by startups on year-on-year basis.

Number of equity funding rounds: H1 Vs H2

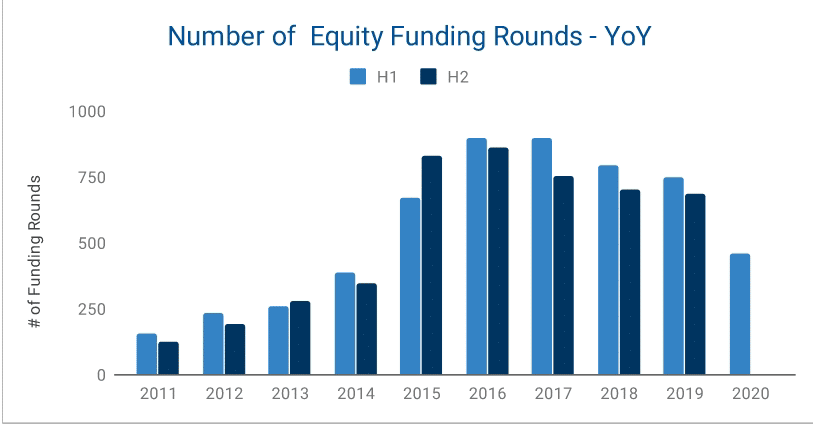

Below is a chart that shows historical data on funding rounds, from 2011-2020. As is evident, the number of funding rounds in H120 has been lowest since 2015.

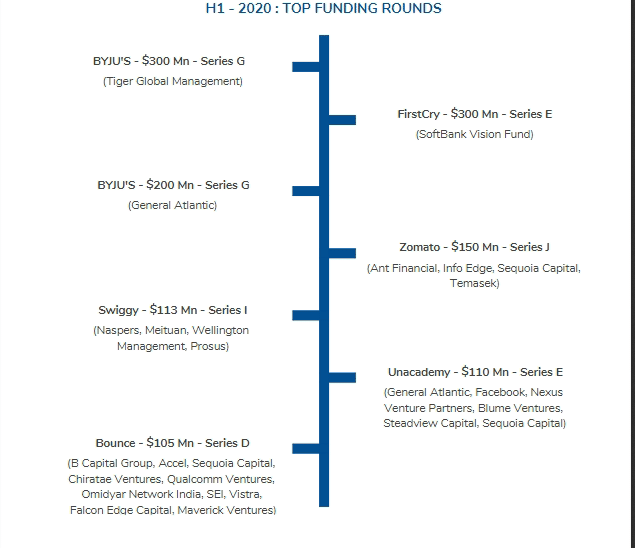

Top Funding Rounds

Despite the grim economic situation, quite a few startups managed to secure big funding rounds during the first half of the current year. The below data includes information about the amount raised by the startup in that round, the stage of funding, and the lead investors who pumped funds in the round.

Please note that below-mentioned data only pertains to equity round and not debt round…

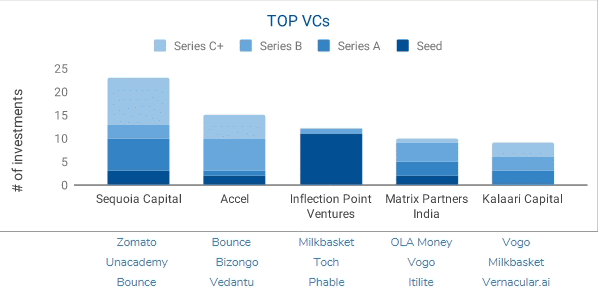

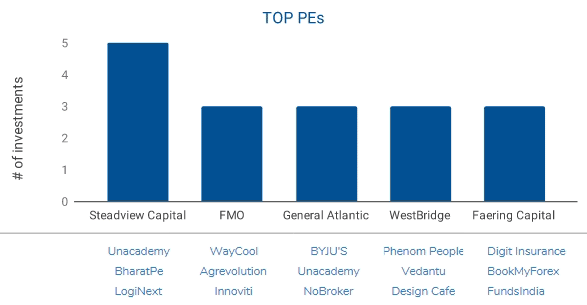

Top Investors

Sequoia Capital and Accel were the two VC firms that pumped highest amount of capital in the startup ecosystem in H120. Steadview Capital and FMO, on other hand, were the top PE investors.

The below chart sheds light on which investors made high number of investments and the notable startups they invested in…

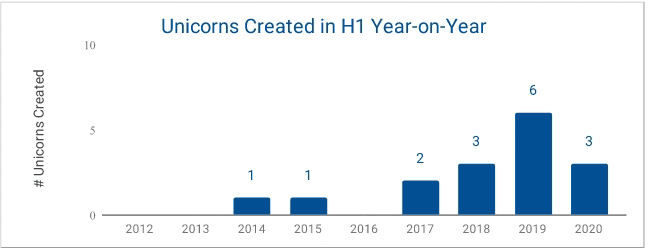

The Unicorn Club

Virtually every startup aspires to enter the coveted world of unicorn but the billion-dollar world belongs only to the chosen few.

The three startups that made an entry in the unicorn club in H120 are FirstCry, Pine Labs and Nykaa.

First Cry: FirstCry is an e commerce marketplace for baby care products. BrainBees Solution Pvt Ltd is its parent company.

Pine Labs: Pine Labs is a B2B Fintech startup that provides POS software solutions for offline retailers and brands.

Nykaa: Nykaa is an e-commerce marketplace for beauty and wellness products.

Top Acquisitions in H120

MediBuddy acquired by DocsApp

Paysense acquired by PayU India for $185 Mn

Paladion acquired by Atos

Dailyninja acquired by BigBasket for $6 Mn

Pokkt acquired by AnyMind Group