In this article we will tell you that Paypal suspends electronic withdrawal for Indians.

It appears that PayPal is playing Ping-Pong with its Indian customers at the moment. Just a couple of hours back, PayPal mailed all its Indian users regarding a ‘new’ update, that hardly sounds new to any Indian by now. PayPal notified all its customers in India regarding a recent change in Money withdrawal policy to Indian banks.

From July 29, 2010 onwards, PayPal will start restricting any electronic withdrawal of funds from a PayPal account, that belongs to an Indian customer. Until further notice, Indian PayPal customers will only be left with Money withdrawal through Cheque, which actually takes ages(2-3 weeks) to reach customers, here in India.

This policy of restricting Electronic Money Withdrawal for Indian PayPal customers will go into effect starting August 1, 2010 and PayPal is implementing this policy to stay in accordance with regulatory instructions(probably from Reserver Bank of India, RBI).

In earlier policy amendments, PayPal has already restricted Personal payments for Indian customers and electronic money withdrawals also went into trouble due to regulatory instructions from RBI. Later, electronic money withdrawal got reinstated with additional formalities and customer outrage toned down since then.

PayPal also forced every Indian customer to submit their PAN(Permanent Account Number), which could have been a mandatory instruction from RBI to PayPal, in order to allow electronic fund withdrawal.

But now, things are appearing to blow out of proportion. PayPal has quoted no specific reason why Electronic fund transfer has again been suspended indefinitely(until further notice). Just like a compensation of free bumper cases by Apple, PayPal has agreed to refund the $5 Cheque withdrawal fee, for all cheques requested on or after July 29, 2010, until the issue gets resolved.

With all these constant hiccups specific to Indian customers, PayPal customers from India are really annoyed and constantly looking for some reliable alternative to PayPal. (Golden moment for MoneyBookers ?)

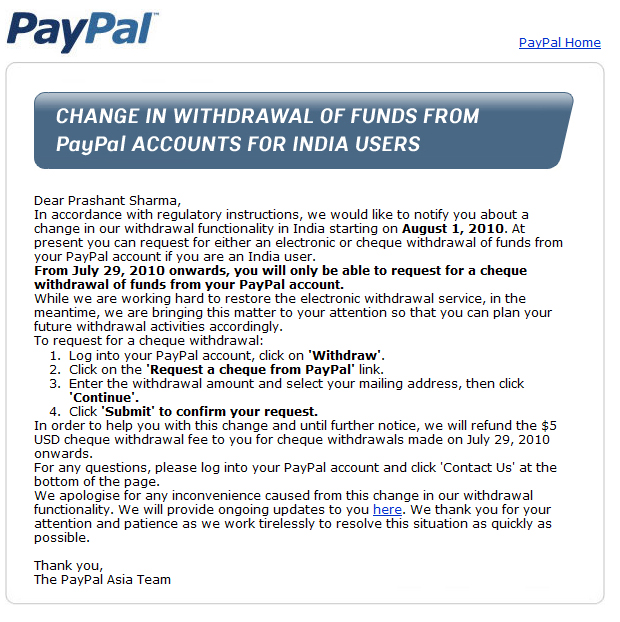

Below is the email snapshot that PayPal sent all its Indian customers. Here is the official blog post over this issue.