Byju’s acquisition of WhiteHat Jr for $300 Mn has become talk of the town in India’s startup industry and all the hype surrounding this deal is rightly justified. For this acquisition deal comes with so many milestones that this deal is likely to set a new precedence for India’s startup industry. To begin with, it is the largest acquisition deal not only in India’s edutech space but also in consumer internet space. But more importantly, this acquisition agreement was a completely all-cash transaction deal, a rarity for Indian startups. And the fact that this rare milestone was achieved by a barely two-year-old startup makes this deal truly historic.

All these great milestones have also meant that WhiteHat’s existing investors – Nexus Venture Partners, Omidyar Network and Owl Ventures – raked massive returns through secondary transaction. All these investors have made a complete exit from the two-year-old company. Techpluto has got information from sources how much return each of these investors earned through the secondary transaction. Please note that this information is not backed by regulatory filings but we can surely vouch that the numbers quoted below are damn accurate.

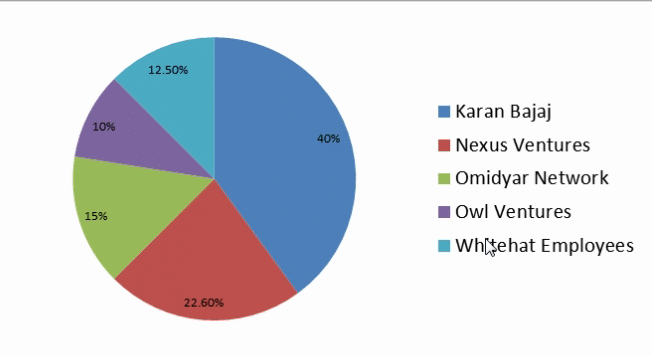

But before coming to the investment returns, check out the below chart to know how much stake did each investors owned in the company before Byju’s buyout. Notably, Nexus, Omidyar and Owl collectively pumped $11Mn in WhiteHat in September last year as part of the series A round. At that time, the Mumbai based startup did not disclose at what valuation it raised the series A funding. However, WhiteHat was recently hunting for a fresh $50 Mn funding round in the market at a valuation of $300 Mn. This was obviously well before the takeover by Byju’s.

As indicated by the above graph, founder and CEO Karan Bajaj owned the largest stake with 40% followed by Nexus Ventures with 22.06% stake for their $5 Mn investment, Omidyar with 15% stake for $3 Mn investment and OWL Ventures 10% for their $3 Mn investment. Employees through the ESOP scheme own the rest 12.50% stake in the company.

Now coming to returns, Nexus made the biggest killing by taking home $66 Mn or 35.3 crore for their $5 Mn investment, fetching almost 13x return on its investment. Omidyar will take home $45 Mn or 23.8 Cr to earn 15x return on its investment while Owl will take home $30 Mn or 21.3 Cr to earn almost 10X return.

Overall, the three investors have collectively made a return of nearly $141 Mn, as for the rest $161 Mn; the big chunk of the remaining $161Mn has obviously gone to Bajaj while the little chunk has gone to WhiteHat’s employees.

Bajaj, by the way, has made a partial exit. By this virtue, he will continue to hold stake in WhiteHat and also lead the company from the front post Byju’s acquisition. Bajaj will now oversee the WhiteHat’s international expansion especially in the U.S. market, which is the next big frontier that Byju’s want to capture to fulfill its international ambitions.

And just to wrap it up, Omidyar can make another big killing in few weeks’ time if Byju’s-Doubtnut deal goes through. Omidyar is one of the existing investors in Doubtnut, which is supposedly Byju’s next acquisition target.