To say that GrowFix is just another investment startup would be bit unfair. After all, it isn’t targeting the already over-crowded online mutual fund and equity investment market. Rather it is seeking to overhaul India’s investment ecosystem by offering improved ‘debt assets’ to retail investors. While investment in debt assets continues to remain low in India, GrowFix is aiming to change this by growing awareness about debt assets and their reliability as a safe investment option.

GrowFix has initiated this arduous journey on an auspicious note by recently raising $2 Mn in a seed funding round. While funding stories have become all too common in India’s startup ecosystem, but GrowFix’s seed funding was a standout affair. Its seed funding round got the backing of some of the biggest titans of the startup industry including Kunal shah, Payu’s Nitin Gupta, Paytm Money’s former CEO Praveen Jadhav and Zerodha backed fund Rainmatter.

GrowFix’s co-founder Ajinkya Kulkarni joins Techpluto to shed light on the recent high profile seed funding round, debt asset ecosystem & the need to grow awareness about it and much more. This is GrowFix’s first major interview following its recent seed funding round.

Q1) What made GrowFix’s co-founding team to target and go after Securitized Debt Instruments (SDIs)?

We ( Co-founders) faced this problem of low-interest rates in FD and debt mutual funds. We come from the lending background so we knew there existed many assets that are high yield and where risk is mitigated well but are not available for retail investors. We started growfix to retailize such assets.

Q 2) Can you please shed light on some of the factors that necessities the need for improved debt assets?

When we looked around we saw many retail investors including us struggling to find avenues which were less risky than equities but would also earn better returns than a FD (returns of which have been falling through cliff over the years) to park their hard earned money and Debt mutual funds lack much needed clarity, We felt that retail investors need to be treated better, and should no longer be stereotyped by the institutional class of investors. This motivated us to develop easy to understand and easy to invest debt products

Q 3) GrowFix’s recent seed funding saw participation of quite a few high profile investors including Zerodha backed fund Rainmatter Capital and CRED’s Kunal Shah? You’re thoughts about the same?

We are glad that such prolific investors believe and are supporting our mission. It feels nice to be supported by people whom we look upto. We are very grateful to all the investors who backed us. But we are also very clear that ultimately what matters is user love so we are focussed on that.

Q 4) How GrowFix plans to leverage the $2 Mn seed funding round to propel its growth?

The funding is going to be used to develop better technology in identifying and underwriting the risks involved and boost the consumer education around debt assets in the country. The retail participation in debt assets has been miniscule till now due to various barriers, But the awareness around fixed income assets among the retail investors is now growing at a faster rate than ever and we want to double down on the opportunity through technology and education.

Q 5) Can you please shed some light on GrowFix’s first asset product ‘GrowFix Gold,’ which was launched in December last year?

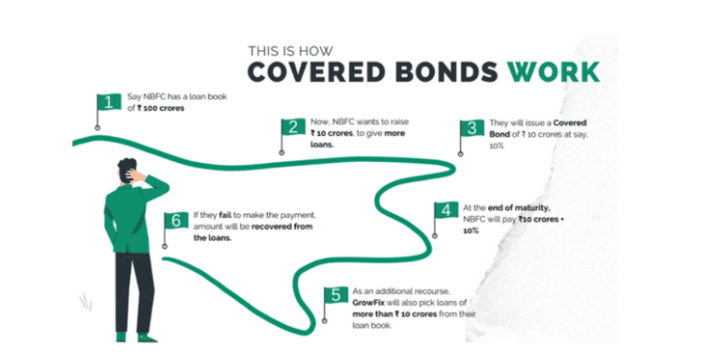

Our first offering GrowFix Gold launched in December 2020 is a pool of loans backed by gold and gives 11% pre-tax annual returns repaid on maturity. It’s a market linked debenture (A debt product with equity like taxation, which makes It very exciting). The beauty of it is that it’s a covered bond providing double protection to the investors. If the NBFC gets bankrupt the investors have full ownership over the underlying collateral of the loans.The pool of loans were disbursed by Kanakadurga Finance Limited, a NBFC which finances Vehicle and Gold loans. We have explained the product and the risks involved with it in detail on our website.

Q 6) What are Cover Bonds, which is one of your unique product offerings?

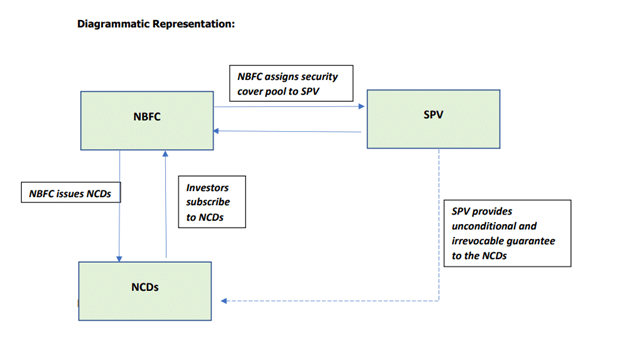

Regular secured bonds or NCDs come with a cover pool of loan receivables as security. However, in case the issuer goes bankrupt, the collections from the security cover pool form part of bankruptcy proceedings and may not go to the NCD investor. This is because the legal ownership of security cover resides with the NBFC. In case of Covered Bond the cover pool is assigned to a Special Purpose Vehicle (SPV set up as trust) which in turn provides an unconditional and irrevocable guarantee to the NCDs. This ensures that even if the issuer goes bankrupt the collections from the underlying cover pool will flow to the investors. The structure is as follows:

- NBFC issues a bond

- A SPV is set up as a trust with NBFC being residual (junior) beneficiary

- SPV uses NBFC’s contribution to purchase high-quality security pool

- SPV provides an unconditional and irrevocable guarantee to the bonds

- Every month NBFCs replenishes the security cover for any rundown or prepayments as per predefined eligibility criteria

Q 7) How really difficult and challenging it is to democratize the access to debt assets, which is today dominated by ultra-rich investors?

Regulatory problems though difficult are still solvable. Our past experiences of working in NBFCs gives us a significant edge in solving regulatory hurdles. NBFCs are more than happy welcoming retail capital; this insight also eased up the process a bit. The key to success will be how happily our product is accepted by the customers, and that depends on the level of trust they place on us.

Q 8) Can you please tell us which are the NBFCs that you’ve tied up with?

We have tied up with about 20 NBFCs and we are working on bringing their assets on our platforms.

Q 9) Finally, what advice would you like to give to all the startup founders and aspiring entrepreneurs?

I am too humbled to be asked this question but we are very early to provide any real advice.