Fintech startup Khatabook, which helps small kirana stores to record their financial transaction digitally through their Android app, claims that it is witnessing greenshoots and recovery in the post lockdown phase. Citing a comprehensive data collected by Khatabook, Khatabook’s co-founder and CEO Ravish Naresh said on his twitter account that Dau (daily active users) and engagement levels on their platform as well as their competitors platforms have seen steady growth in the post-lockdown phase.

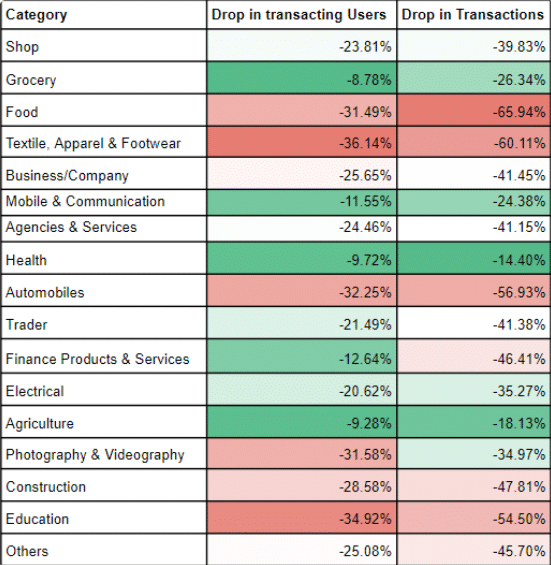

Ravish said that DAU dropped almost 50% across all the categories during the first week of lockdown, though the drop was comparatively lower for grocery (-9%), mobile (-12%), health (-10%) and agriculture (-9%).

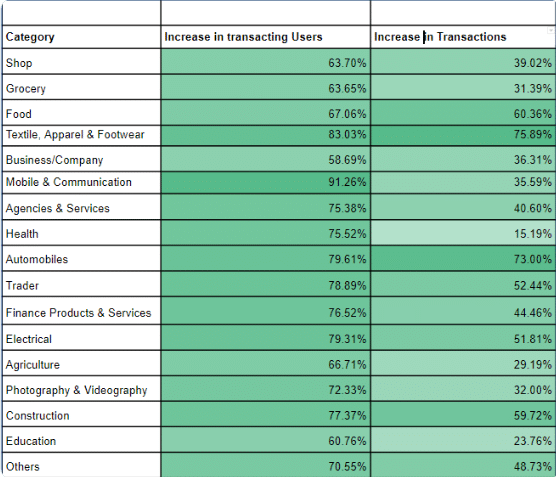

However, Khatabook’s CEO and co-founder added that engagement level started increasing as soon as lockdown was lifted. He claimed that during the post lockdown phase (May 18 to June 10) important categories like automobiles and textiles witnessed impressive recovery, clarifying that these two categories were badly hit during the lockdown period.

Speaking exclusively to Techpluto about post-lockdown recovery Ravish said “Increased dependence of people on local Kirana stores or shopkeepers was one of the major reasons for the recovery of the tech service providers during COVID19.”

He further added “As per the recent EY report, Kirana stores are opting for Digital methods to better manage increase in workflow. The Kirana store owner’s new-found digital appetite has been encouraged by the promotion of contactless payments like UPI and QR to avoid cash based transactions and increase contactless payments.”

Speaking specially about Khatabook’s recovery in the post-lockdown he said “Khatabook app is widely used by essential service providers, hence the use of Khatabook was not deeply impacted during COVID19.”

When inquired about whether this post-lockdown phase is self-sustainable in the wake of massive challenges Ravish said “The usage of Khatabook application is expected to see an increase in the post-pandemic era, as small entrepreneurs are increasingly inclined towards digital methods given the convenience it offers both customers and merchant.”

Ravish, however, refused to disclose how this post lockdown recovery will reflect on company’s monthly or upcoming quarterly performance.

About Khatabook

Khatabook is a digital credit ledger that helps small shopkeepers to record credit (Jama) and debit (Udhaar) transactions for their trusted customers. Customers can avail their services through an android app. The company was founded by Ashish Sonone, Dhanesh Kumar, Jaideep Poonia, Ravish Naresh and Vaibhav Kalpe.

The company had last raised funds in May this year, securing $60 Mn from B Capital and other investors. $70 Mn funding round that took place in February this year preceded this round. Chinese internet giant Tencent, Kunal Shah and Rohit Bansal are among its many high profile investors.